603 fico score

07-26-2013 0106 AM fico score 603 Hi everyone Im new to this forum. Some credit card issuers might still consider a credit score as low 720 to be excellent but most issuers have raised the bar to 750.

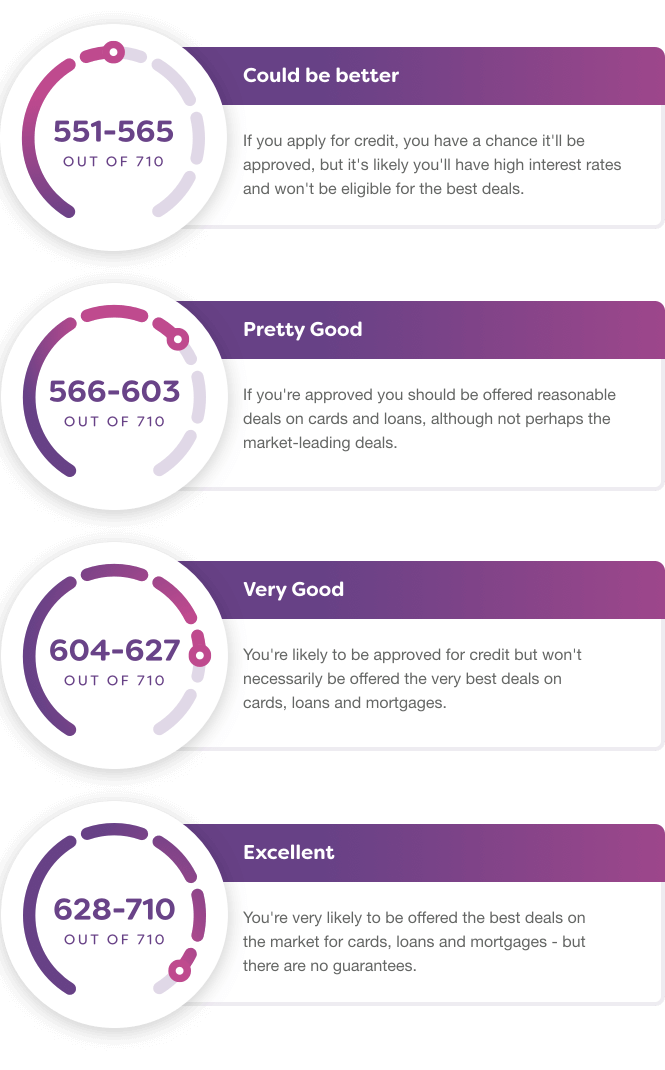

What Is A Good Credit Score Moneysupermarket

The minimum credit score is around 620 for most conventional lenders.

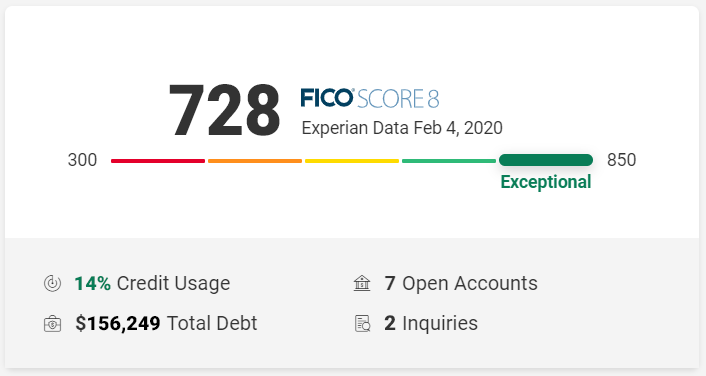

. Now I have a 603 with EQ and 599 with TU merrick bank. First FICO Score 9 disregards all paid collection accounts. Along with your score youll receive a report that uses specific information in your credit report that indicates why your score isnt even higher.

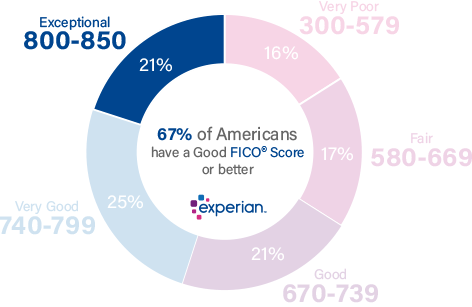

The best way to determine how to improve your credit score is to check your FICO Score. The FICO model gives credit-using adult consumers a credit score between 300 and 850 ranging from very poor to exceptional. Your 603 FICO Score is lower than the average US.

Im trying to rebuild my credit. Double your credit line by making at least your minimum payment on time each month for the first 7 months your account is open. However for those interested in applying for an FHA loan applicants are only required to have a minimum FICO score of 500 to qualify for a down payment of around 10.

Those with a credit score of 580 can qualify for a down payment as low as 35. Statistically speaking 28 of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future. Can I get a home loan with a credit score of 603.

Still a 703 FICO score does put you in the good credit category. Some lenders dislike those odds and choose not to work with individuals whose FICO Scores fall within. Because your score is extraordinarily good none of those.

From FICO Small Business Scoring Service SBSS to FICO Score 10T there are several types of FICO scores to familiarize yourself with as a business owner. 604 Credit lines range from 550-1350 which double to 1100-2700 after your account qualifies. It means that lenders are likely to consider you for loans and lines of credit but with interest rates that are higher than average.

What does a 603 credit score mean and how it affects your life. Among consumers with FICO credit scores of 803 the average utilization rate is 115. In order to get approved with a 603 credit score expect to have strong compensating factors such as conservative.

FICOs credit-scoring models use either a range of 300 to 850 or a range of 250 to 900 but in either case higher credit scores can indicate that you may be less risky to lenders credit card issuers and other types of lenders. Capital One Auto Loan and 603 FICO. Some lenders might see that youre half way to bad credit or half way to fair credit.

Second FICO Score 9 differentiates between unpaid medical collections and unpaid non-medical collections. A FICO Score is a three-digit number between 300 and 850 that tells lenders and other creditors how likely you are to make on-time. You may also find it challenging to get approved for some types of mortgages or other financing options.

The score however will impact your finances negatively as your credit report will indicate to the lenders that you have a high. I paid all my debt at this point my score is tied to credit utilization. A credit score of 603 falls into the fair range which includes scores between 580 and 669essentially if you have a 603 credit score it.

I started at EQ 576 TU 463 and EXP 521 back in May 17 when I pulled all my credit reports. Here are eight FICO Scores and what they are used for. Ultimately it depends on the lender.

Your score will differ slightly among each agency for many reasons including their unique scoring models and how often they access your financial data. Why Good Credit Matters. A 603 FICO score is basically a glass half empty glass half full debate.

Mortgage auto and personal loans are somewhat difficult to get with a 603 Credit Score. Lenders normally dont do business with borrowers that have fair credit because its too risky. A credit score of 603 is considered poor however it will still get you an auto-loan some types of credit cards a home loan and even a personal loan especially from online lenders.

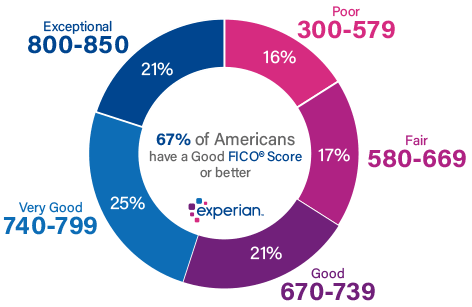

Today an very good credit score is a little higher and is usually defined as 740-799 with scores above 800 considered exceptional. At 547 just over half the population has a score of 700 or above. Statistically speaking 28 of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

My experian FICO score which the lender used wasnt much better than yours in November and I had no problem getting a loan though my auto enhanced scores are better than my normal fico8 scores. Monitoring of all five of these credit scores on a regular basis is the best. About 23 of people have a score between 600 and 699 and 22 of people have a score of less than 600.

A 603 credit score can be a sign of past credit difficulties or a lack of credit history. These changes were implemented based on extensive research showing they would improve the scores predictiveness. Whether youre looking for a personal loan a mortgage or a credit card credit scores in this range can make it challenging to get approved for unsecured credit which doesnt require collateral or a security deposit.

A credit score of 603 is considered to be in the Fair range. Fortunately you can still get approved for a USDA loan with a 603 credit score but it will require a manual approval by an underwriter. Your 603 FICO Score is lower than the average US.

USDA Loan with 603 Credit Score. Each credit agency provides you with a credit score and these three scores combine to create both your 603 FICO Credit Score and your VantageScore. FICO Small Business Scoring Service SBSS FICO Score 2 4 5.

A 603 FICO Score is considered Fair. 485 59 votes A FICO Score of 603 places you within a population of consumers whose credit may be seen as Fair. No security deposit required.

Given the tremendous interest in medical debt its. 17 of all consumers have FICO Scores in the Fair range 580-669. I had 2 chargeoffs and a related collection all paid.

That means nearly a quarter of Americans either have poor credit or are on the border of dipping below the 579 threshold. The minimum credit score requirement for a USDA loan is now a 640 for an automated approval.

Car Loan Interest Rates With 603 Credit Score In 2022

603 Credit Score Is It Good Or Bad What Does It Mean In 2022

603 Credit Score Good Or Bad Credit Card Loan Options

600 Credit Score Is It Good Or Bad

603 Credit Score What Does It Mean Credit Karma

603 Credit Score Is It Good Or Bad What Does It Mean In 2022

What Credit Score Do You Need To Get A Car Loan

What Are The Different Credit Score Ranges Experian

The Different Credit Score Ranges

Credit Com Mobile Free Credit Score Monitoring Credit Manager Credit Score Finances Money Free Credit Score

How Is Your Credit Score Determined Experian

Is 603 A Good Credit Score My Worthy Penny

How Do You Check Your Credit Score Experian

Improve Your Credit Score With Openroad Lending

The Different Credit Score Ranges

603 Credit Score Good Or Bad Credit Card Loan Options

Is 603 A Good Credit Score My Worthy Penny

800 Credit Score Is It Good Or Bad

My Progress Thread Credit Scores In The 400s Rea Myfico Forums 5853330

Comments

Post a Comment